Structuring Capital Stacks in Commercial Real Estate: The Ultimate Guide

Understanding Capital Stacks in Commercial Real Estate

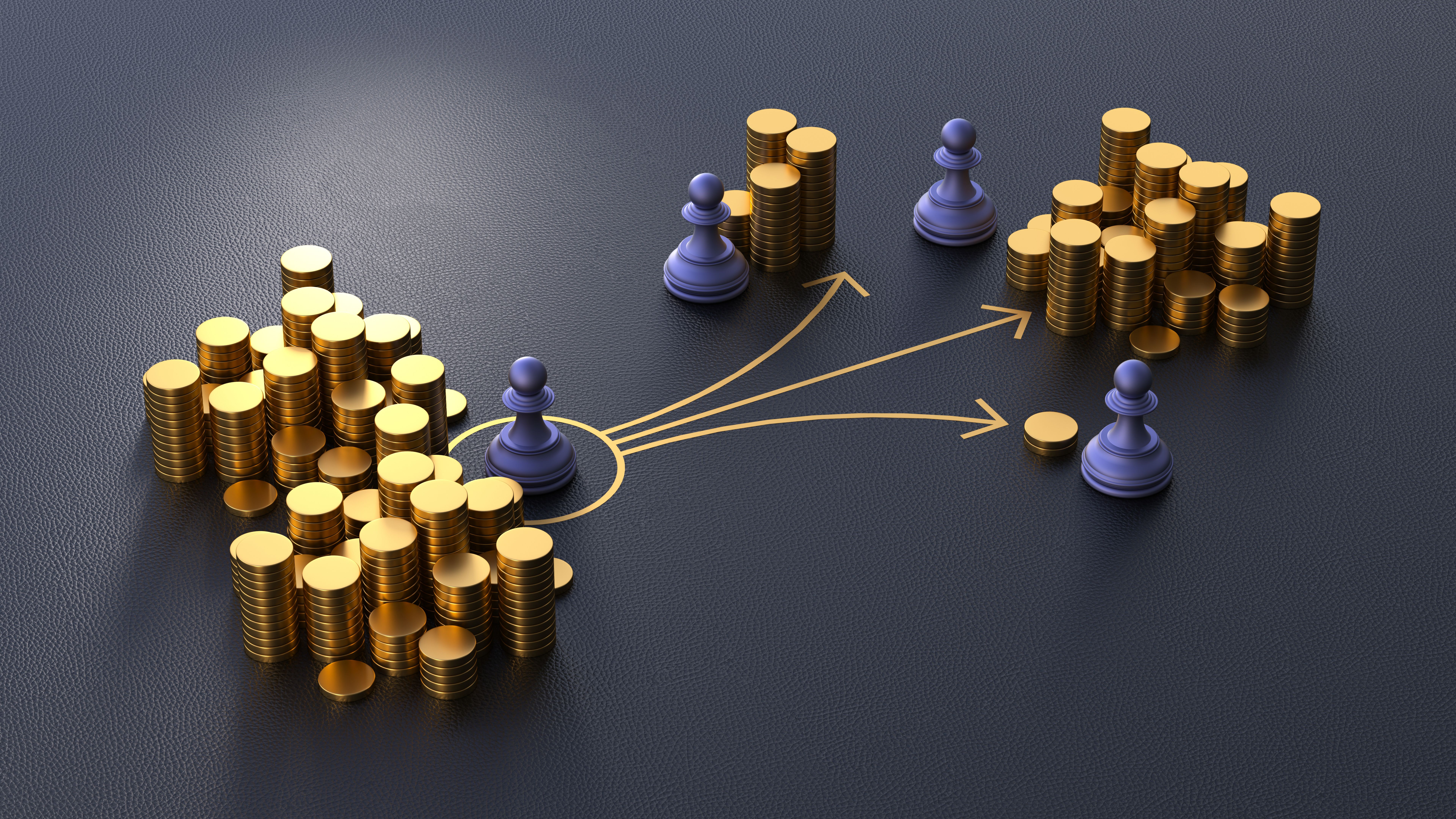

In the realm of commercial real estate, structuring a capital stack is essential for maximizing returns and minimizing risks. A capital stack refers to the layers of debt and equity that are used to finance a real estate project. Each layer comes with its own risk and return profile, influencing the overall financial structure of the investment.

The primary components of a capital stack include senior debt, mezzanine debt, preferred equity, and common equity. Each part plays a critical role in the financing structure, offering different levels of security and potential returns to investors. Understanding how these components interact is vital for creating a successful investment strategy.

The Layers of a Capital Stack

Senior Debt

At the top of the capital stack is senior debt, which is typically secured by the property itself. This layer carries the least amount of risk because it has the first claim on the property's assets in case of default. As a result, it usually offers lower interest rates compared to other forms of financing.

Mezzanine Debt

Below senior debt lies mezzanine debt, which is often used to bridge the gap between senior debt and equity. This type of financing is subordinated to senior debt, meaning it has a lower claim on assets. However, it offers higher returns due to the increased risk. Mezzanine financing can be structured as either debt or preferred equity.

Preferred Equity

Preferred equity sits below mezzanine debt in the capital stack. It provides investors with a fixed return, but unlike debt, it does not have a set repayment schedule. Preferred equity holders are paid before common equity holders but after debt obligations have been met. This layer offers a balance between risk and reward, appealing to investors seeking stable returns.

Strategizing for Smart Capital Stacks

Balancing Risk and Reward

Structuring a smart capital stack requires careful consideration of the risk-return profile of each component. Investors must assess their risk tolerance and financial goals to determine the optimal mix of debt and equity. A well-structured capital stack can help mitigate risks while enhancing potential returns.

Leveraging Market Conditions

Market conditions play a significant role in shaping capital stacks. During periods of low interest rates, investors may opt for higher leverage with more senior debt. Conversely, in volatile markets, a more conservative approach with increased equity may be prudent. Understanding market dynamics is crucial for aligning capital stack strategies with prevailing economic trends.

The Role of Innovation in Capital Stacks

Emerging technologies and innovative financing solutions are reshaping the landscape of capital stacks in commercial real estate. Crowdfunding platforms, blockchain technology, and other digital tools are providing new opportunities for investors to diversify their portfolios and access alternative financing sources. Staying informed about these innovations can give investors a competitive edge.

In conclusion, structuring smart capital stacks in commercial real estate involves balancing various layers of financing to achieve strategic investment objectives. By understanding the intricacies of each component and adapting to market conditions, investors can optimize their capital structures for better risk management and enhanced returns.